For mortgage brokers, generating leads is the name of the game. The more leads you have, the greater the chances of making a sale. But how can you generate more mortgage broker leads?

Word-of-mouth and referrals are effective, but a mortgage broker in today’s world needs alternative approaches that support their offline methods with online lead acquisition strategies.

At MBW, we have a digital-first mentality to lead generation, because not only does this allow mortgage brokers to track performance and measure return on investment, it also provides diversification of lead channels and an avenue for low-cost lead generation. With now over 22.31 million internet users in Australia, prioritising your digital marketing efforts is a sound investment for the future.

We understand that for some mortgage brokers, the digital world is a black hole, so we wanted to share 5 ways you can generate more mortgage broker leads from your mortgage broker website.

1. Target brand and local searches for mortgage broker leads

Your brand is your greatest asset, and as you share your business story with others you are inadvertently strengthening your brand awareness. Every conservation, email and message is an opportunity to give your brand a greater chance of recall, and the best way to translate this recall to mortgage leads is to ensure that your website ranks #1 when someone searches for your brand.

This is often very simple to do as brand names for most businesses are the least competitive keywords on Google. So make sure that with each page you create, your meta titles and descriptions include your brand name in it.

Once you have done this, register your website in both Google and Bing using Google Search Console Tools and Bing Webmaster Tools. This will ensure that search engines are crawling your website and it is coming up in search results – more in this below.

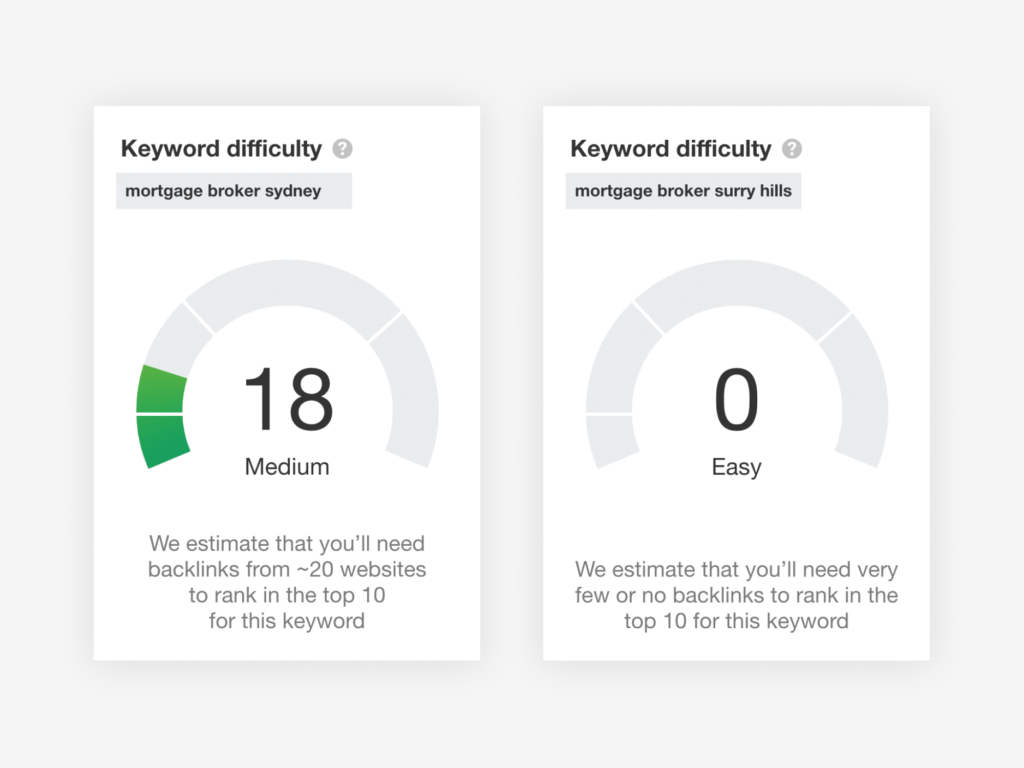

Furthermore, an SEO strategy based on local search phrases is a great way to focus on less competitive search terms with higher relevance. For example, instead of trying to target ‘Mortgage brokers in Sydney’, if you were a mortgage broker that was based in Surry Hills, you could instead focus on ranking on the first page of search engine results for ‘Mortgage broker Surry Hills’.

Note the keyword difficulty when comparing both terms suggest that it could be more effective to target searches for ‘mortgage broker surry hills’ assuming it was relevant to the mortgage broker leads you wish to generate for your business.

You can find more information on keyword difficulty using one of the many SEO tools available on the market such as Moz or Ahrefs which allow you to track keywords over time.

The same technique of comparing keyword difficulty can be applied to any unique services or specialisations your broking practice offers. Thus you should make sure you rank high for the services that set you apart rather than the generic key phrases that everyone may be competing for.

Such a strategy may not necessarily result in large amounts of traffic, but you can always be assured that the traffic you get will be of higher quality that is more relevant to the business. The expected result will be a greater conversion rate of traffic to leads, and subsequent leads to sales.

2. Optimise for cross-device and mixed browser usage

While getting a website up and running is a lot easier these days, a common mistake made is to believe that when a website looks good on your computer, it looks good for everyone else’s device.

In fact, one of the most common mistakes we find with mortgage brokers is the lack of cross-device and cross-browser testing carried out on their website.

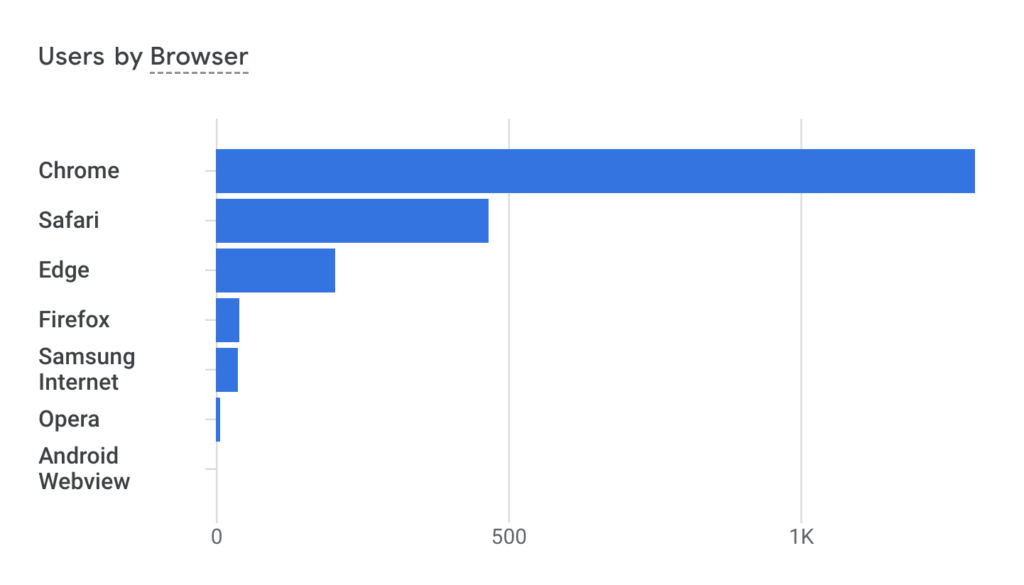

Often the case, when a website is tested and working on a single browser – for example, Google Chrome – it can be mistakenly assumed that it works across all other browsers. In reality however, browsers all act differently from one another, and browser usage can differ greatly between users making it crucial that your website is tested and optimised for all the popular browsers being used in the market.

Optimise lead generation for cross-device and mixed browser usage

Here you can find a sample of the browser usage across our own MBW website taken from last month. What is clear is that while the majority of our users prefer to use the Google Chrome browser, there is still a significant percentage of users on Safari and other browsers.

Using this dataset as an example, if we had incorrectly assumed that the MBW website was working across all browsers but in fact was optimised only for Chrome, we would be losing out on 40% of our total traffic, and as result, would most likely be weakening our lead generation capabilities by a significant amount. In other words, any marketing campaign or traffic being generated would be only operating at 60% efficiency.

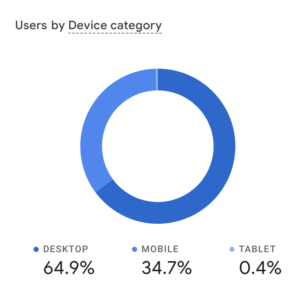

A similar issue occurs in the case of mobile and tablet users. Again looking at the data from the MBW website, we found that mobile users represent 34% of our total traffic.

This means that not only should we ensure that our website functionality is equally suitable for all browsers, we should also consider the mobile user experience as an integral part of our mortgage broker leads acquisition strategy.

3. Use Data to Measure Funnel Effectiveness

We like to think of lead generation strategy as the process by which you first attract opportunities, and then convert these opportunities into leads to then become potential customers. Another way to see this is the efficacy of your online sales funnel.

As part of your strategic thinking you should be contextualising your mortgage broker leads in a funnel format representing the journey of your target demographic.

In the first few funnel actions (red sections), we look to drive more relevant traffic to your website, and then take systematic steps to convert the traffic into opportunities. In the case of home loans for example, this could be driving traffic of people looking to buy their first home or a couple looking to refinance an existing home.

Historical data from your funnel can then tell you where and how you need to improve.

In the sample above taken from the MBW website after we revamped some key pages, the data reveals that our website changes had a direct correlation to the reduction in bounce rate and improvement in average session duration.

What this data also tells us is that our redesign was valued by users who in return were better engaged on our website – a fact corroborated by the small uptick in leads generated we have enjoyed since.

While there are many methods to measure and improve the sales funnel it is imperative that you always start at the areas you can expect the highest returns (see #4). To determine this, you can use tools such as Google Analytics or Crazy Egg to measure your website’s current performance across the sales funnel, and then take action based on the insights the data reveals.

Using data to make informed decisions can also help you when your budget is limited, and give you a starting point for where you can focus your efforts when looking to generate more mortgage broker leads.

4. Master your forms and CTAs

A common mistake that a lot of mortgage brokers make is to overly focus on generating traffic, and not enough on optimising the website traffic that they have in order to convert opportunities into leads. The resulting impact can be traffic that never actually converts or contacts your mortgage broker business.

When we work on conversation optimisation we focus on the lowest hanging fruit first, which is usually the areas closest to the conversion point, such as your forms. This is because it is generally expected that any improvements to your website form’s performance has a direct correlation to the mortgage broker leads you will generate as it is the last step in the process of generating a qualified lead.

In an experiment by Marketo, tests found that a reduction in form field length increased the conversion rate and reduced the cost-per-lead significantly. In this instance, the amount of fields was reduced from 9 to 5.

This demonstrated that shorter forms can be more effective in getting website visitors to complete them. The trade-off is obviously that a shorter form means you are collecting less information which can make the lead a little more unqualified.

While there are exceptions to the rule above, the key takeaway is that users are only willing to fill out fields and give data that is relevant to themselves and the scenario at hand. So in the case of getting a home loan for example, the user’s expectation may well be that more fields are sufficiently in line with their expectations to receive an accurate service – just don’t provide fields that are irrelevant to the needs or expectations of the user.

Another interesting case study by Dan Siroker (CEO of Optimizely), demonstrated how the call-to-action (also known as CTA) and imagery can have a big impact on your bottom line. Dan performed a number of A/B tests during his time working on the Obama campaign landing page and found that by tweaking small things he could greatly improve the sign-up and donate rates.

To do this he created a control, and then split his traffic between the control ‘A’, and the variation ‘B’, in order to assess and compare the results of each.

In the original control the CTA button text Dan’s team used said ‘SIGN UP’ while the new variation was changed to ‘LEARN MORE’. The change signified a slight tonal variation to be more open and less daunting.

Ultimately this small change increased the conversion rate by over 40% which represented an additional $60 million in donations from regular subscribers!

At MBW, we often get asked what is the best way to write your CTAs and we always suggest a user centric approach. This means that a good CTA will always focus on the user’s expectation, and always correlate to what the user expects to receive on the other side of their click once the action has taken place.

For information on traffic generation specifically, read how to keep customers engaged and generate new prospects in a cost effective way.

5. Boost your website ranking with these free Google services

We may have mentioned Google quite a bit already but it is important to note that the main reason for this is because of their dominant position in both the search engine and browser market. It effectively means that when Google makes changes to their algorithm or applications, the whole world tends to sit up and pay attention.

With this being said, Google themselves provide Australian businesses with free tools to help them get their business profile registered and increase their visibility online.

Google My Business is one such tool which allows mortgage brokers to connect with more potential customers across Google Search and Maps. From your Google My Business profile, you can manage how your business appears and keep customers up to date with your contact information and hours amongst other things.

Best of all, by having a business profile it has been shown to improve your website traffic, especially for local search. Google themselves have said when someone searches for a business or place near their location, they will prioritise local results in places like Maps and Search.

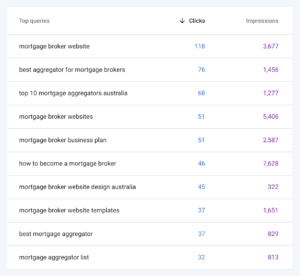

Another valuable resource to use is Google Search Console. This powerful tool allows you to monitor, test and track your website pages in order to gauge which ones are performing best for your business.

We use Google Search Console to inform our lead generation strategy at MBW because it provides us with information about the top queries coming to our website, and has the additional ability to sort these queries according to their respective landing pages.

If you remember the sales funnel in the previous chapter, you will note that this information is vital to measuring how effective you are at driving traffic to your website, and then adapting based on the information at hand.

Both Google My Business and Google Search Console are free for all businesses. You simply have to prove your ownership of the business and domain for Google to give you access.

To gain deeper insights into the evolving landscape of mortgage broker marketing trends in 2023, consider visiting our dedicated page. We provide comprehensive information and valuable insights into the strategies, tools, and best practices that are shaping the industry this year.

For more information or help, you can speak to your website provider who will be able to assist with getting you registered. Alternatively, contact MBW and our team can assist you with your mortgage broker website and marketing needs