The banking sector has undergone significant turbulence in recent years, facing challenges such as scandals, fraud, and cyberattacks. In an era marked by uncertainty, the importance of developing a strong brand cannot be overstated. With increased competition from fintech startups, digital-only banks, and non-traditional financial services providers, banks must continue to build trust and convince customers that they are committed to delivering exceptional value.

The importance of developing a strong bank brand

The significance of building a robust brand for banks cannot be overstated. It is not merely an option but a requirement in an industry that hinges on trust and reliability. A strong brand serves as a compass, guiding customers through the unpredictable terrain of finance, assuring them that their most precious asset – their financial well-being – is safeguarded by an institution that takes its commitments seriously.

Opportunities in digital marketing for banks

In an era marked by the transformative shift from physical branches to a digital presence, the importance of a strong bank brand becomes even more pronounced. As banking interactions increasingly occur in the digital realm, the brand becomes one of the few tangible connections between the bank and its customers.

And, in the growing absence of a physical space where customers typically experience the bank’s culture, interact with staff, and assess its credibility in real life, the brand and its digital presence becomes the primary interface. It is, therefore, imperative that banks meticulously consider their brand and how it is presented to customers whose only interaction may be online.

Future proofing your banking identity

The digital landscape offers both opportunities and challenges for banks in terms of branding. On one hand, it allows for a more extensive reach and the ability to connect with customers across vast geographical distances, including even outside Australia. On the other hand, it poses the challenge of conveying the bank’s values and personality solely through digital channels, which can be a complex task when face-to-face interaction is limited. This new age dynamic makes the banking sector more competitive, as there are many renowned global brands investing substantial time and effort into digital finance initiatives. Banks must keep pace with this trend, innovating and investing in their digital presence to ensure they stand out in an increasingly crowded marketplace.

Large financial institutions dominate a crowded banking marketplace.

Here are three considerations for banks in the new digital landscape:

- Create brand consistency across channels and platforms – Banks must recognise that different customers engage differently on various platforms, each with unique communication styles and expectations. Instead of broadcasting a uniform message, banks need to tailor their communication to resonate with the specific audience on each platform, while maintaining a consistent core brand message.

- Cultivate an engaging story that resonates with target audiences – When physicality and tangibility are absent, the story and mission of a brand become the elements that audiences resonate with. This narrative gives customers a reason to choose one bank over another. By creating a compelling story, banks can give purpose and meaning to their brand, making it more than just a financial institution, but a part of their customers’ lives with shared values and goals.

- Experiment with new branding strategies – The digital realm offers an opportunity for agile experimentation with branding strategies. Unlike traditional media, digital platforms allow for quick testing and iteration of ideas. This ‘fail fast’ approach enables banks to innovate and evolve rapidly, keeping pace with changing consumer behaviours and preferences. In a digital context, it’s less costly to experiment, making it a conducive environment for trying out new branding techniques in smaller sample sizes, measuring their impact, and adapting strategies accordingly.

Using data to drive decision making

One of the core benefits of digital marketing for banks is the ability to gain insights from data and analytics. In today’s data-driven era, banks can no longer rely solely on traditional marketing channels without clear metrics or outcomes.

Digital marketing offers a wealth of data that allows banks to track and measure the effectiveness of their campaigns with precision. By analysing customer behaviour, engagement rates, conversion metrics, and other key performance indicators, banks can make informed decisions, optimise their marketing strategies, and tailor their messaging to target specific customer segments.

With digital channels, almost all key metrics can be tracked on a regular basis.

This data-driven approach not only enhances the efficiency and effectiveness of any marketing efforts but also ensures that resources are allocated where they can generate the highest return on investment, ultimately leading to better customer engagement and retention.

Investing in digital marketing and online branding

Many community banks and credit unions continue to invest substantial sums in building and renovating physical branches as they expand into new markets. While this approach has traditionally been the hallmark of establishing a local presence, often these institutions hesitate to allocate even a fraction of the same resources to branding and digital marketing efforts.

While investing millions in brick-and-mortar locations can enhance a bank’s physical footprint, it’s important to recognise that today’s consumers are more connected than ever through digital channels. Neglecting the online space can be detrimental, as it restricts a bank’s ability to reach and engage with a broader customer base.

With changing consumer preferences, a presence in the digital landscape is not just an option; it’s a necessity. The issue is not about spending exorbitant amounts; rather, it’s about finding a balance between physical presence and digital accessibility. Embracing digital marketing and branding can be a cost-effective approach compared to the construction and maintenance of physical branches. It allows banks to establish a strong online presence, engage customers where they spend a significant portion of their time, and create a seamless and convenient experience.

To remain competitive and relevant, community banks and credit unions must recognise the importance of both their physical and digital presence, ensuring that customers can easily work with them and find them, regardless of their preferred interaction channel.

Case Study: Hume Bank

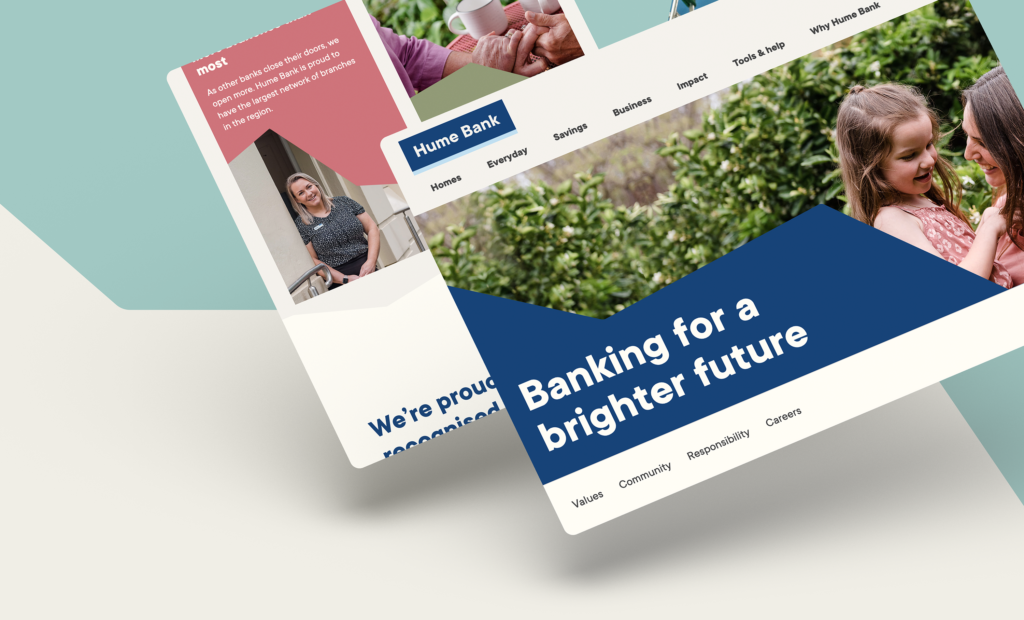

Hume Bank, a regional financial institution located in Albury-Wodonga, has a rich history that spans over six decades, with a primary mission to assist local residents and the community in realising their dream of home ownership. In a dynamic and evolving financial landscape, the bank recognised the need to revitalise its digital offerings to not only meet the changing needs of its local community but also to expand its reach beyond the region. To achieve this transformative journey, they partnered with a creative technology studio S1T2. Together, they embarked on a comprehensive process to reimagine and reinvent their entire digital ecosystem, reshaping the way Hume Bank engages with its customers.

Hume Bank underwent a branding project recently to future proof their digital offering.

The transformation journey was multifaceted, encompassing a range of critical elements. Firstly, a refreshed brand identity was crafted to resonate with the bank’s heritage while projecting a modern, customer-centric image. This visual identity aligned with the vision of a more inclusive and expansive Hume Bank. Simultaneously, the bank’s website underwent a modernisation process, providing customers with an intuitive and seamless digital experience to better access key products.

Beyond the public-facing website, the project also included the creation of a feature-rich Broker Portal, designed to enhance the bank’s services for brokers and streamline their operations. With a focus on improving customer engagement, the new digital ecosystem integrated features such as seamless onboarding, an intuitive content management system, and robust analytics, offering valuable insights to support ongoing customer interaction and satisfaction.

Distinguishing the Hume Bank brand

Although Hume Bank boasts an appealing array of products and services, it encounters the formidable task of setting itself apart from the multitude of other financial institutions within the industry. Consequently, the primary creative dilemma revolved around establishing a unique identity that would set Hume Bank apart from its competitors. With this objective in mind, it was decided that Hume Bank embrace its rich heritage as a customer-owned bank within the region, but project the meaning of these values in a way that could resonate with customers outside the region.

Implementing analytics for tracking key events

As part of the rebrand and redesign, Google Analytics 4 (GA4) was implemented for advanced tracking capabilities to monitor and analyse key events and user engagements across critical pages and products within the digital ecosystem. This implementation provided Hume Bank with invaluable insights into customer behaviour, enabling them to construct a comprehensive digital funnel for assessing the performance of each web page and product. By meticulously tracking user interactions, it was possible to identify pain points, drop-off rates, and areas of opportunity throughout the customer journey.

With this data-driven approach, it was possible to embark on an iterative journey to enhance the website designs and optimise user experiences, ultimately benefiting bottom line and conversion rates. By understanding where users were engaging most and where they were dropping off, Hume Bank could make informed adjustments to their page designs, content, and user pathways. As a result, noticeable improvements in conversion rates were achieved, reaffirming the value of data-driven decision-making in shaping the future of the brand.

Support with your bank branding

If you find yourself in need of assistance with your branding or would like to explore more information on how to strengthen your brand identity, we invite you to learn more about our dedicated branding services. Our team of experts can guide you through the intricacies of crafting a compelling and resonant brand that aligns with your organisation’s values, goals and target audience.

Brand expenditure across major banks

When we examine brand expenditure among prominent banking institutions, it is evident that the four major banks allocate substantial budget to branding and marketing endeavours. This is because their strategic approach is driven by being top-of-mind, focusing on positioning themselves as lifestyle service providers rather than mere product vendors.

This conscious investment reflects the sheer clout and size of these banking institutions as they can afford to create a brand that embodies a multitude of financial aspirations and desires, targeting a diverse spectrum of customers. Their expansive budgets enable them to continually reinforce this all-encompassing image, nurturing customer loyalty and establishing a formidable presence within the financial landscape.

Compete by focusing on niche bank branding strategies

In a landscape dominated by giants, smaller banks and financial organisations such as customer owned banks or credit unions must employ niche bank branding strategies to effectively compete. Bank Australia serves as a prime example of a bank that has successfully branded itself on sustainability by advocating for responsible banking, resonating with a customer base that prioritises ethical and environmentally conscious financial choices.

When a customer-owned bank offers specialised products or services that align with their niche branding strategy, it not only attracts customers seeking tailored solutions but also fosters a sense of community and shared values among its members, creating a deeper connection and loyalty beyond mere financial transactions. This personalised approach allows smaller institutions to stand out and thrive in a competitive financial landscape dominated by larger players.