The competitive landscape of real estate and asset financing demands that a mortgage broker not only understands the market but also excels at connecting with a varied client base. Generating a consistent flow of leads is critical — encompassing first-time home buyers, seasoned property investors, and entrepreneurs in need of asset finance.

As a mortgage broker, you are a facilitator in the financial decision-making process, offering guidance and options to those looking to purchase homes, invest in property, or secure financing for other assets. The leads you’re pursuing represent a spectrum of financial needs and goals, each requiring a tailored approach that combines professionalism with market insight. Your challenge is not just to attract a volume of leads but to cultivate a quality relationship with a diverse clientele, each with unique circumstances and aspirations.

What are mortgage leads

Mortgage leads are potential clients who have expressed interest in obtaining a loan for purchasing property or refinancing an existing mortgage. These prospects may come from various sources, such as online forms, social media inquiries, referrals, or direct marketing responses. They represent individuals or businesses at different stages of the loan acquisition process, some gathering information, others actively seeking to secure financing. For mortgage brokers, these leads are the starting points of the sales pipeline, offering opportunities to convert inquiries into completed transactions through careful nurturing and tailored financial solutions.

Getting mortgage leads requires building a sales funnel for online and offline channels

How do you get leads as a mortgage broker

Acquiring leads as a mortgage broker involves a layered and strategic approach, taking into account the varied avenues through which potential clients can be reached. While at MBW we focus strictly on generating qualified mortgage leads through online channels. It’s essential when you run your brokerage to craft a comprehensive plan that encompasses both digital and traditional methods.

Here’s an expanded look at how this strategy might unfold:

- Networking: Establish relationships with real estate agents, financial planners, and existing clients to gain referrals.

- Online presence: Create a professional mortgage broker website and utilise search engine optimisation (SEO) to improve visibility to those searching for mortgage-related information.

- Social media marketing: Engage potential clients through platforms like Facebook, LinkedIn, and Instagram with informative content and targeted ads.

- Content marketing: Offer valuable information and insights through content marketing, such as buying guides or investment tips, to attract leads by establishing your expertise.

- Paid advertising: Use targeted online and traditional advertising to reach specific demographics.

- Partnerships: Form alliances with local businesses to cross-promote services.

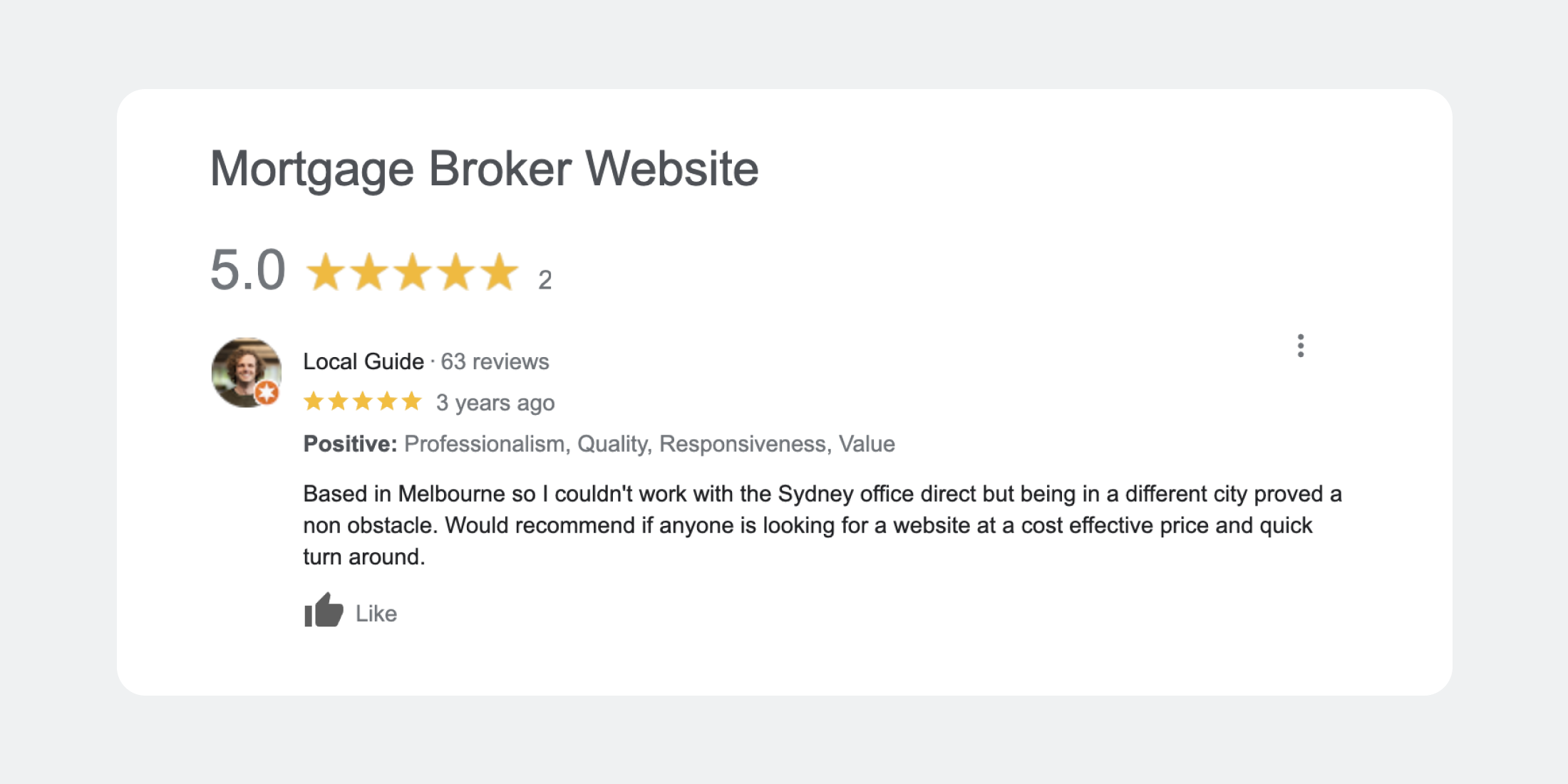

- Customer reviews and testimonials: Encourage satisfied clients to leave positive reviews, enhancing your reputation and credibility.

- Email campaigns: Send out newsletters and personalised offers to both new prospects and existing clients to keep them engaged.

- Educational workshops and seminars: Host events that help potential clients understand the mortgage process, positioning yourself as a helpful and knowledgeable industry expert.

Are there ways to get free mortgage leads?

The concept of obtaining a ‘free mortgage lead’ might seem appealing but in reality, such leads always come at a cost, albeit not always monetary. Generating leads through organic methods like networking, content marketing, or engaging potential customers on social media requires a significant dedication of time and resources. Nevertheless, the effort put into these methods can be immensely rewarding. Establishing a reliable lead generation system through these channels often results in a loyal client base that is engaged and trusting of your brand.

Shifting to the other end of the spectrum, the practice of buying leads is sometimes seen as a quick fix to boost client numbers. However, this approach is inherently flawed as it leans towards a short-term solution, failing to foster sustainable growth that is reliant on 3rd parties for lead provisioning. It lacks the foresight needed for long-term success and the cultivation of a reputable and recognisable brand presence.

For enduring success and a cost-effective approach to lead generation, a long-term strategy is key. This involves investing in your brand and refining your own marketing efforts to ensure they yield the highest return on investment. By focusing on building and nurturing your brand’s reputation through high-quality, targeted marketing efforts, you can eventually attract leads organically. This approach eliminates the dependency on costly third-party lead sources. Emphasising the optimisation of digital assets, leveraging SEO, and engaging in strategic content marketing are proactive steps that can dramatically reduce acquisition costs. Over time, this strategy not only lowers expenses but also builds a pipeline of warm leads who are familiar with and trust your brand, leading to higher conversion rates and better client retention.

Optimise your digital tools to reach online customers for mortgage broker leads

How to generate mortgage leads from your website

Word-of-mouth and referrals remain gold standards in the mortgage industry, but in the digital age, brokers must complement these tried-and-true methods with robust online strategies to generate leads. A well-designed, conversion-optimised website acts as your virtual storefront, working around the clock to attract and convert prospects.

To harness the full potential of your website, it’s essential to implement search engine optimisation (SEO) so that potential clients can find you at the top of their search results. SEO involves optimising your website’s content and structure to improve visibility on search engines like Google for relevant keywords and phrases. This starts with thorough keyword research to identify the terms that potential clients use when searching for mortgage advice or brokers. By embedding these keywords strategically throughout your website’s content – such as in titles, headings, and meta descriptions—you improve the chances that search engines will rank your site higher in the search results, increasing visibility.

Beyond keywords, SEO also entails optimising the website’s backend elements, such as improving site speed, ensuring mobile responsiveness, and securing your site with an SSL. These factors contribute to a better user experience, which search engines reward with higher rankings.

Moreover, building a network of backlinks from reputable external sites is crucial, as search engines view these links as a vote of confidence in your content’s quality and relevance. Engaging in local SEO practices, like listing your business in local directories and optimising for local search terms, can also capture the attention of potential leads in your area.

By focusing on these SEO practices, you create a strong online presence that can significantly enhance your website’s ability to generate leads organically, effectively complementing your offline referral efforts.

For more detailed guidance, including how to enhance lead generation using targeted local searches, be sure to visit our resource for tips on how to generate mortgage broker leads from your website.