How to create the best mortgage broker website in 10 key steps

10 minute read

You’ve probably visited websites that failed to impress, but did you know that a visitor typically decides if your website is right for them in 7 seconds?

The absence of a professional website could lead to lost opportunities and leads – but being unaware of your website’s effectiveness can be an even bigger issue. We’re here to tell you how you can avoid all that and instead create the best mortgage broker website for your brokerage.

1. Build a digital brand

Working in the financial industry and dealing with numbers all the time, it’s easy to forget that the products and services you provide are for humans. This is why the first step to having a great website is to focus on your brand. Building a strong digital brand is a fundamental aspect of long-term success for any mortgage broking business, and it’s important to take into account how your brand and visual identity is engaged with across various digital formats.

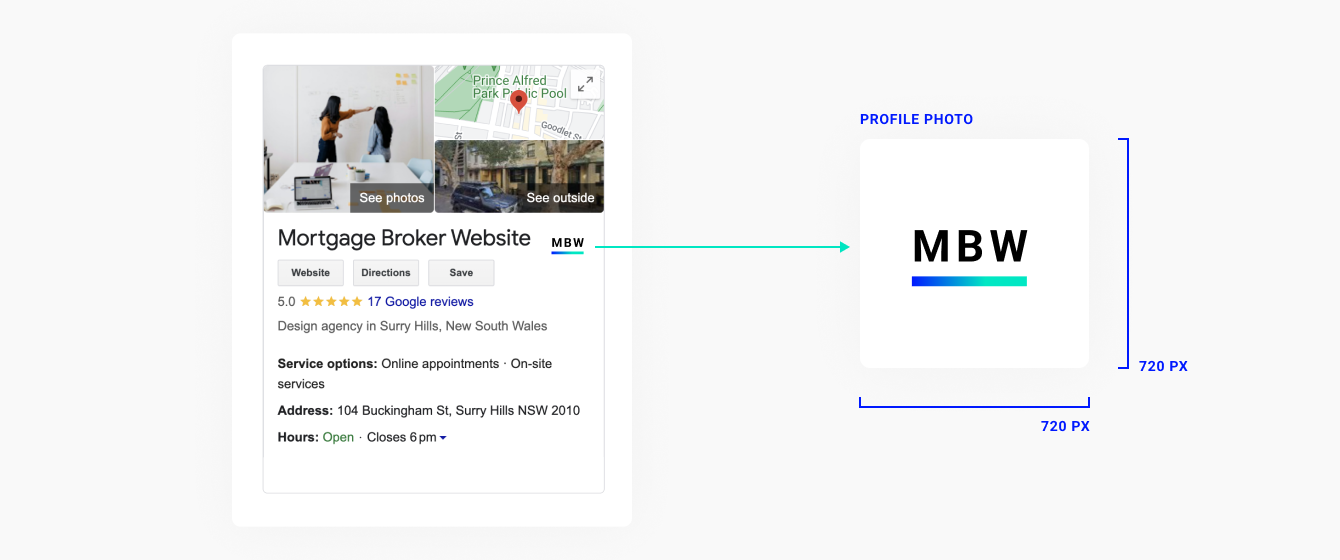

Google’s Business Profile and many other platforms use square aspect ratios for profiles

For example, given that most platforms such as Google Business Profile, Instagram and Facebook, use square-shaped favicon and profile pictures, it’s crucial to design a logo that is versatile and legible in this aspect ratio. This means creating a logo that maintains its clarity and impact across diverse resolutions, and then considering how your branding will be extended to your website design. A well-designed logo that adapts seamlessly to different formats enhances brand recall and recognition.

2. Content is king

There are so many benefits to having great content that it is absolutely integral to think about content structure and strategy before you begin making your mortgage broker website. Google has said many times that the key to getting your website to rank higher is to produce quality content or ‘E-A-T’. This means the content you create must demonstrate Expertise, Authority, and Trustworthiness (E-A-T), which will then naturally increase your ranking on search engines.

Consistent updates are essential to maintaining the integrity of your content. This requires that any mortgage broker website content, including interest rates, facts, and contact details, remains accurate and relevant over time. If you lack the time or resources to manage this on an ongoing basis, consider using experts in content marketing services for high-quality content creation.

Another useful tip is to focus your content on what you think matters to customers. For mortgage brokers, this could mean providing information about the services you offer, your compliance and credentials, or even the professional organisations you are associated with.

3. Be responsive in your website design

Visitors to mortgage broking websites are typically conducting extensive research on home loans or finance, and as a result, tend to browse on larger screens for a better-informed experience. However, it’s equally crucial to ensure your website is functional and visually appealing on smaller screens, such as mobile devices and tablets. With mobile traffic today accounting for a significant portion of web usage, a responsive design ensures that your website adapts seamlessly to different screen sizes, providing an optimal user experience across all devices.

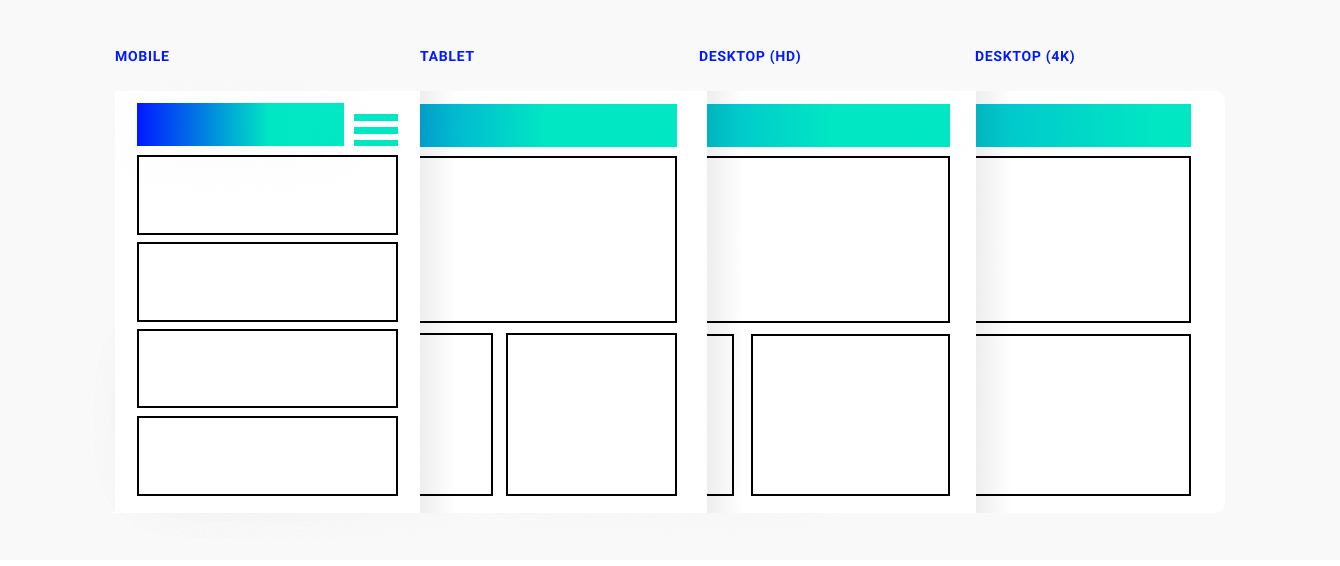

Today your website must work across all devices and resolutions

Being fully responsive implies that your website is optimised to work across all resolutions, browsers and operating systems available in the market. To properly implement responsive design, you need to consider your customer journey – what do clients do differently across portable devices compared to desktop computers, and how do their objectives differ within these mediums? The best mortgage broker website design will always consider these differing circumstances to provide an optimised user experience across all devices.

Looking for help with a website

4. Understand your website data

The digital tools at our fingertips have made it easier to gain business insights, yet most businesses are not using their data in any meaningful way. Often one of the most neglected aspects when mortgage brokers create a website is the data and analytics.

Brokers should have a method for collecting and accessing data on their website, and also dedicate time to check if the analytical tools are setup correctly so that any data collected can inform decision-making. Often a misconfigured implementation can lead to months of valuable insights being lost, and in our experience, we have found that the majority of analytical tools used are not setup accurately to capture the most relevant data. Engaging a marketing consultant can mitigate this issue and may be invaluable in enhancing your overall digital strategy.

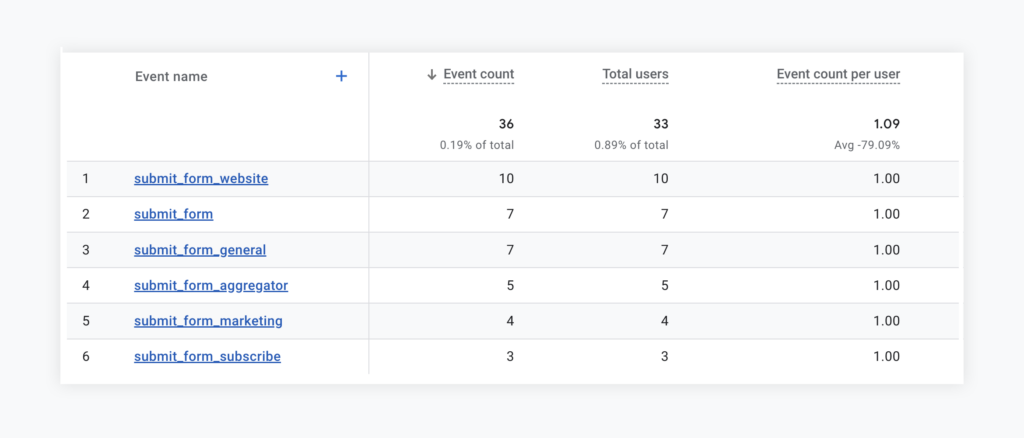

Behavioural events can help you track conversion rate

5. Use industry specific mortgage broker tools

When you start looking into the specifics of which website design agency you want to engage with to make your mortgage broker website, you will quickly find that there are a wide range of studios, platforms, and content management systems on the market – some are even free.

At the end of the day however, the adage ‘you get what you pay for’ rings true with mortgage broker websites. The key to finding the best mortgage broker website design is to find a company that focuses specifically on the industry. That way you will be working with experts that are familiar with your needs while paying a price that you know is derived from the value returned to your business.

One quick way to know if the agency you are working with is right for you is to ask them what industry-specific tools they integrate with. If they aren’t familiar with some well-known calculators or tools then they probably don’t have much specific industry experience. This is particularly important because if your website does not include industry-specific tools then you may well be losing customers who are interested in finding out more information on their home loan repayments or borrowing capacity before engaging with you.

Your customers want to know that you are an expert, and they will be looking for features on your mortgage broker website that helps them understand how you can help their unique financial situation. Having the right tools tells prospects you know how to provide value.

6. Promote your mortgage broking expertise

Most of us operate in a highly competitive market where the options for alternative products or services are abundant. In order to differentiate your business, clients are looking for what makes you special. Research has shown that for industries such as mortgage broking, locality matters more-so than other services, but bear in mind, locality by itself is not enough to win you deals.

When you are writing your website content, you need to present your expertise in detail. This can include your qualifications and anything else that you believe gives your website credibility such as awards and testimonials. When it comes to designing websites for example, we talk about our design style, how we can help customers and what process we follow to create the best mortgage broker websites designed for mortgage brokers.

If there is a particular area your brokerage specialises in, then consider creating content pages to specifically highlight that expertise, and consider using other forms of engaging content such as videos and infographics that feature your business as a subject matter expert.

7. Make your mortgage broker website easy to navigate

When you are looking to create the best mortgage broker website structure, you want to think about how your audience and users are going to be navigating between pages and content. This will allow you to create a structure that best reflects the information that users wish to find.

For example, if your main menu will have ‘Services’ in it, then it is best to create a sitemap that categorises all the respective services such as refinancing, pre-approval and business loans into that one section. Otherwise, not only does it become difficult for users to understand where to find content, but it also makes it more challenging for your content to be crawled by search engines.

The best mortgage broker websites structure their content in a way that can make a significant difference to your Google ranking. Search engines often try to imitate a ‘human user’ as they crawl through websites, therefore how your pages flow together will contribute greatly to improved ranking. We find that the best mortgage broker website designs all have a user experience that organically flows between information and content across the entire website.

8. Pick a sensible web address

The best mortgage broker websites have a great web address – also known as a domain – which is crucial to attracting more visitors to your website. We are often asked by our clients, what is a great domain? To help you determine how to pick a domain for your business be sure to follow these simple principles.

Match your domain with your brand

If your business is called ‘John’s Mortgage Broking’, then don’t call your website ‘Adam’s Kitchen’. This is an extreme example of course to demonstrate the point, but you want to make sure that your domain name reflects the content that a user will see when they click through and visit your website.

All visitors expect to view a website that is relevant to their search query so if you are presenting a domain that may be misinterpreted or misunderstood then it is best to avoid the name altogether. When visitors are mislead, not only could this adversely affect your brand, but it may also result in a penalty by search engines for misconduct.

Make your web address easy to spell

If your web address is unnecessarily long then it could be losing you traffic. A large number of searches on the internet are what we call ‘brand searches’. This means that a user will type in your website or brand name and expect to see your website appear at the top. The problem that often arises is that when your web address is one that is difficult to spell, then some visitors may get lost along the way. If this were to happen, your brand goodwill that you’ve spent years to foster could very well be going to your competitor.

A simple trick we like to use is the test of ‘can my 16 year old niece spell my website address’. If the answer to this question is no, then your domain may be too challenging. The best mortgage broker websites match their business name with their domain name.

9. Find a managed service for your mortgage broker website

Due to the nature of how websites are designed and developed, it is easy to be overly focused on the initial ‘going live’ period. And while the process of designing and getting a website online is an exciting one, often this pales in comparison to the importance of creating content and maintaining your website over time to keep it fresh and secure.

It is important to think of your website as an evolving entity that grows as you do. This means that updates, patches and content shouldn’t stop when you go live, but rather, going live merely represents the first milestone of becoming a digital brand. This is why the best mortgage brokers always perceive their websites as long-term assets that grow with the business.

Keep your website up-to-date with mortgage broker content

Keeping your website up-to-date with relevant mortgage broker content is essential for attracting potential clients. As the mortgage industry evolves, your website should reflect the latest trends, regulations, and market insights to position your brokerage as a trusted source of information. Regularly publishing fresh and informative content, such as blog posts, articles, and educational resources, not only helps in attracting organic traffic but also establishes your expertise in the field.

In addition, keeping your website current with timely updates and news shows visitors that you are actively involved in the industry and committed to providing valuable guidance. By consistently offering valuable content, you can enhance your website’s credibility, drive user engagement, and ultimately generate more leads for your mortgage brokerage.

Protect your mortgage broker website with security updates

Did you know that due to the way browser updates take place on computers around the world, your website could be out-of-date as early as next week? In the same way your computer goes through updates of its own, security patches for your website system are also released on a regular basis. A security patch could include server updates, an application release or even just a database backup.

The main difference is that if you aren’t updating it, then nobody is. This means that if you aren’t routinely updating or patching your website, your business could be at risk.

The true cost of a website

If the digital agency who created your website is planning to ‘love you and leave you’ once your mortgage broker website is complete, then you may want to reconsider using them. Inversely, if your current website designers are charging you an arm and a leg to regularly maintain or make changes, then you may want to look into a more cost-effective solution.

The true cost of your website is not just the fees you pay to get your website live, but also the time and money that goes into keeping it running, ongoing updates and any additional content changes. You may even want to consider the costs of disaster recovery in the event of an incident.

By making sure you consider the total cost and not just the initial website design fees, you are properly protecting one of your businesses most valuable assets. Finding the right company who can properly manage this asset can alleviate any potential incidents that may occur, and more importantly give you the platform your business needs to grow.

10. Help customers find your mortgage broker website

Now that you’ve made the best mortgage broker website in Australia the last thing to make sure to check is the process of getting in touch with you and your company. One common mistake that we see time and time again is that a business’ contact details can be too difficult to find.

Most visitors look for a contact page when they want to connect with your business, but we recommend our clients try to make things as easy as possible for visitors by putting both their number and links to forms on key pages, as well as having a contact page.

Different customers want to connect in different ways

Another thing to consider is that some customers may have preferred methods of connecting. In this day and age, you cannot expect every customer to get in touch via a phone call. You should know that the best mortgage broker websites offer a wide range of communication methods to their website visitors so that they get in touch with you in the method that is most comfortable for them.

Alternatives to the phone could be an email address or contact forms on your website that allow you to capture and qualify leads without being overly intrusive. For each form you have on your website make sure to have a clear call-to-action. This way you are giving your business the best chance of being contacted by those customers that aren’t quite ready for a phone call or face-to-face.

Provide your mortgage broker business credentials

When you are creating your mortgage broking content strategy you may want to consider the overall marketing funnel. Understanding the various steps in the decision making process for a new customer will help you to create a website that will turn traffic into leads, and leads into sales.

Towards the latter end of the marketing funnel, a visitor may be considering their intent and evaluating the service on offer. This is where you want to be clearly demonstrating your value proposition and business credentials including your ABN, trading license and even the aggregator group your business is associated with to reaffirm your credibility. Things like this can sway an uncertain customer from considering to actually getting in touch with your team.