The Sydney property market, renowned for its steady growth and strong demand, is showing signs of a significant change. In October, we spoke about Australia’s rising inflation and the impact it has on mortgages around the country, today we share the latest data from CoreLogic that indicates a shift from the rapid price increases that have characterised the property market over the past few months to a more stabilised and possibly declining phase. This change is likely attributed to various factors, including rising interest rates, increased property listings, and changing buyer sentiments. As the market cools, it’s becoming increasingly important for investors and potential homeowners to reevaluate their strategies, keeping an eye on the long-term implications of this shift.

Peak and subsequent slowdown in Sydney property prices

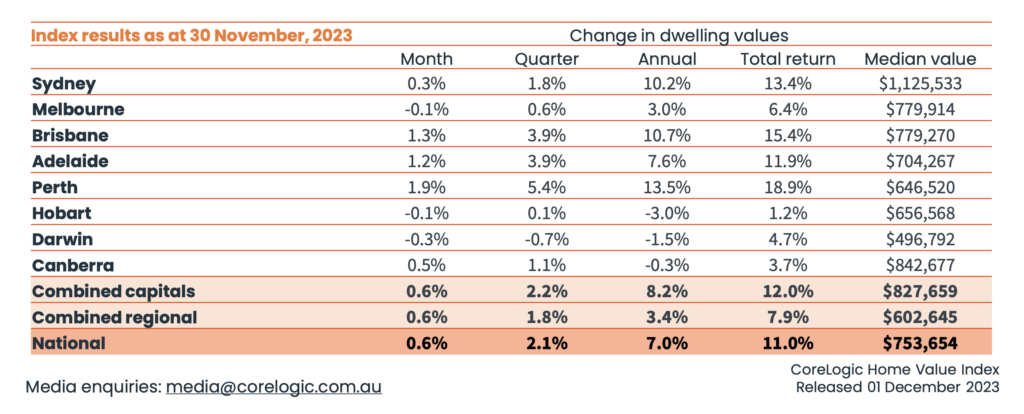

A lot has changed since the reported rebound of Sydney property prices in May, and identifying when prices peaked is crucial to understanding the current slowdown. The market experienced a period of unprecedented growth, reaching record-high prices last month. However, recent data indicate a shift, with growth slowing down. CoreLogic’s national Home Value Index (HVI) reported only a 0.6% increase in November, the smallest monthly gain since the growth cycle began in February. This marks a significant departure from the rapid increases earlier in the year.

The current landscape suggests that the market may be transitioning from a seller’s market, dominated by high demand and limited supply, to a more balanced environment where buyers may have more leverage and negotiation power. This evolving scenario offers both challenges and opportunities, making it a critical time for stakeholders in the Sydney property scene to stay informed and adaptable.

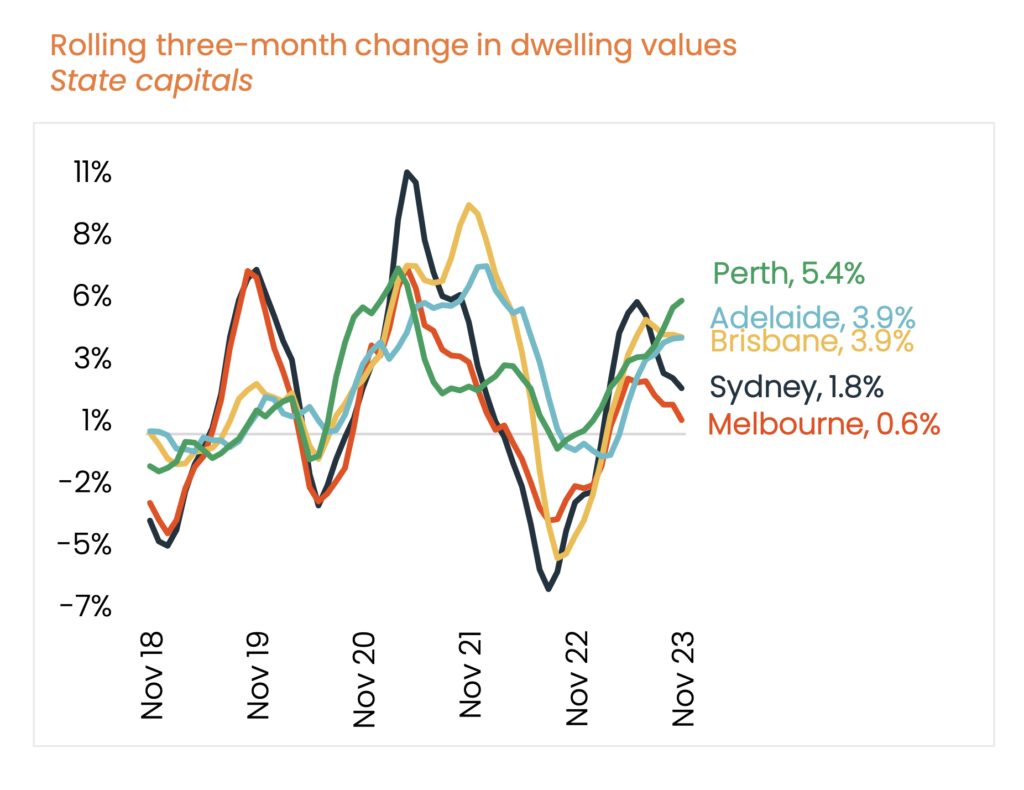

Comparison with other capital cities

Sydney’s market cooling is part of a broader trend affecting several Australian cities. Melbourne and Hobart experienced slight decreases in property values, both down by 0.1%, and Darwin saw a 0.3% decline. Sydney’s growth also slowed significantly, with a 0.3% increase, the smallest since the start of the recovery cycle. By the end of November, Sydney property values had even dipped into negative growth, suggesting that December might see stabilising or decreasing values, following Melbourne’s pattern.

Source: CoreLogic Home Value Index

Factors influencing the market’s cooling

The cooling of the property market is influenced by various factors. The interest rate hike around Melbourne Cup day played a major role, as increased borrowing costs typically dampen market enthusiasm. Other contributing factors include a rise in advertised stock levels, declining affordability, and consistently low consumer sentiment, all of which are slowing property value growth.

Adding to this complexity, the Reserve Bank of Australia (RBA) and some leading economists from major banks have indicated the potential for more rate hikes in the near future. This possibility of further increases in interest rates adds an additional layer of uncertainty to the property market. Prospective buyers and current homeowners are facing the prospect of higher mortgage repayments, which could further cool the demand for property. This potential move by the RBA is a response to broader economic conditions, aiming to balance inflation and economic growth, but it undoubtedly has a direct impact on the property market, influencing buyer decisions and market dynamics.

The impact of increased vendor activity

The increase in vendor activity has been a significant factor in the market’s slowdown. Beginning unusually early in winter, there was a rise in new listings, following a prolonged period of below-average levels. This surge in available properties has given buyers more options, reducing the competitive pressure that drove prices up in the past.

Future trends: when will property prices fall in Sydney?

The current indicators suggest that Sydney’s property prices may be nearing a more pronounced downturn. Rising interest rates, an influx of new properties on the market, and ongoing affordability challenges are converging to potentially stabilise or reduce prices. This change could herald a shift towards a more buyer-friendly market, providing opportunities for those previously priced out during the market’s peak.

While predicting the market’s exact direction remains challenging, current trends point towards a cooling phase. This could lead to more balanced conditions, potentially offering new opportunities for buyers. The question “When will property prices fall in Sydney?” is complex, but the market seems to be adjusting to new economic realities. Prospective buyers and sellers are advised to stay informed and carefully consider their options in this evolving market.