Mortgage broker leads generation and mortgage leads in Australia

QUICK LINKS

QUICK LINKS

Grow your business by generating qualified mortgage leads and attracting customers through tested mortgage broker lead generation practices.

Develop a steady flow of mortgage leads

Establish a reliable source of mortgage leads to expand your client base.

Data-driven outreach for measuring results

Measure and track the effectiveness of your lead generation efforts.

Cost effective and industry proven

Optimise your marketing spend with our industry-proven strategies.

Lead generation for mortgage brokers in Australia

Before you start generating mortgage broker leads you must have a clear idea on who your customers are. To use a fishing analogy, you need to know what species you are catching and apply the right bait. Generating mortgage leads is no different. While it is possible to acquire mortgage broking leads in many ways, across both offline and online channels, we recommend brokers focus their efforts for better results.

Return on investment

Digital marketing is an effective approach for mortgage lead generation in Australia due to the ability to accurately measure ROI, as well as the large portion of Australians frequenting online resources for research and finance decisions.

With expertise across a variety of channels including search engine optimisation (SEO), our team can support your efforts to generate mortgage broker leads. To get started, simply get in touch.

Speak to an expert

Supporting more than 500 mortgage brokers for over 17 years

How we generate leads for mortgage brokers

Lead generation for mortgage brokers has previously relied on word of mouth, however more recently, brokers are opting to develop digital campaigns due to their ability to provide a steady flow of prospects. Apart from consistency, one of the other benefits in building your own lead generation funnel is that over time you can generate more qualified leads at a lower price point.

Sustainable lead generation for mortgage brokers

Often the best approach for mortgage broker lead generation is the one that is most sustainable. As part of our mortgage broker lead generation service, we fully manage the lead generation process for you, giving insight into the performance of your campaigns, and then refining your sales funnel to reduce the total cost per lead over time.

Create a website optimised for conversion

To help mortgage brokers with generating leads online we provide professional website design packages optimised for lead generation. This is a critical step in lead generation because often the websites that mortgage brokers have are not designed with lead capture in mind, and as a result, any money spent on generating new mortgage broker leads is wasted due to poor conversion rates.

Get qualified leads now

Supercharge your mortgage broker business by generating a steady stream of qualified prospects and leads.

Using content marketing to enhance mortgage broker leads generation

Beyond investing in your own website, having the right content strategy can greatly support your mortgage lead generation efforts. By consistently delivering valuable and informative content that addresses the questions and concerns of potential borrowers, you can establish your authority and build meaningful connections that drive leads and conversions.

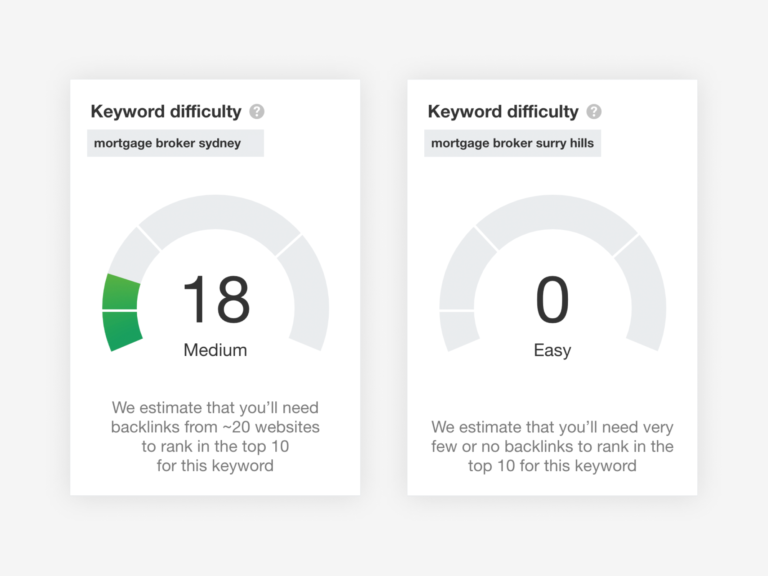

There are also occasions where focusing on locally relevant content over generic industry keywords can reap better results. Through blog posts, videos, and engaging social media content, it is possible to position your brokerage as a local expert, building trust and attracting quality leads in areas of focus. We often recommend mortgage brokers optimise their presence in local listings, capturing the attention of clients across specifically target areas rather than focus on more competitive results.

Mortgage broker lead generation services

Our comprehensive lead generation services encompass everything from mortgage lead nurturing to tracking and reporting, ensuring transparency and accountability throughout the process. With our tailored solutions, mortgage brokers can focus on what they do best while we take care of generating a consistent flow of high-quality mortgage leads to fuel business growth.

Website and user experience design for mortgage leads in Australia

A good website design will consider how layout, user experience and content altogether contribute to on-site conversion. As part of generating mortgage leads in Australia, there are a number of techniques that can be used to improve conversion in order to increase your output of qualified mortgage broker leads. This can include, but is not limited to, writing your content to be catchy and action-driven, designing your forms to remove unnecessary fields, adding credibility indicators such as testimonials, logos and reviews, as well as strengthening your call-to-action copy.

It is imperative that when your website is designed, the team has the goal of increasing conversion rate in mind. By focusing on website user experience (UX) you can often generate quick wins that directly contribute to your business’ bottom line.

SEO for mortgage brokers

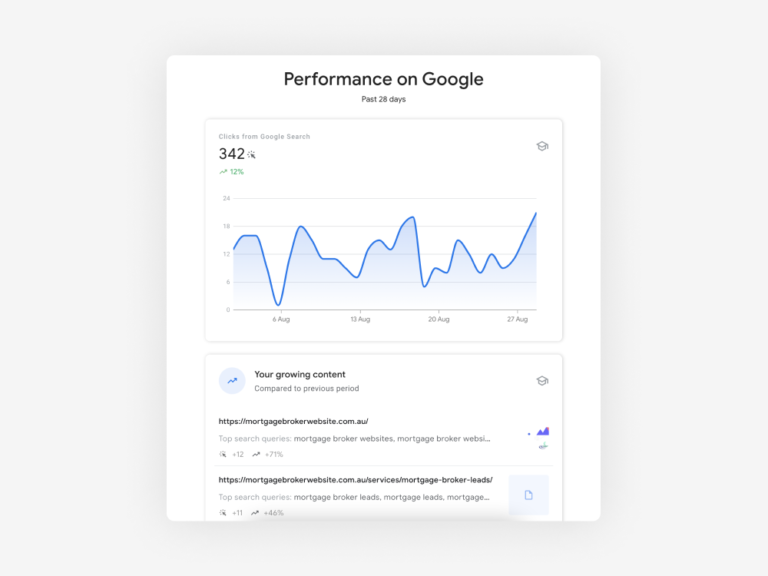

Search engine optimisation or ‘SEO’ for short, plays a crucial role in helping mortgage brokers improve their online visibility and search engine ranking. With specialised SEO services for mortgage brokers, we can optimise your website and content to rank higher in search engines. Then, by optimising meta tags, improving website speed and ensuring mobile responsiveness, your website will be well-positioned to capture potential clients actively searching for mortgage and home loan related information.

Social media marketing for mortgage brokers

Social media marketing for mortgage brokers offers tremendous opportunities for brokers to connect with their target audience and foster long-term relationships. Our specialised social media marketing services for mortgage brokers are designed to leverage the power of platforms such as Facebook, Instagram, LinkedIn, and Twitter to enhance your online presence and drive business growth. As part of this service, we create social media campaigns using content such as articles, videos, and interactive posts. By strategically targeting an audience based on demographics, interests, and behaviours, we can ensure your message reaches the right people at the right time.

Digital marketing for mortgage brokers

Our digital marketing services for mortgage brokers encompass various strategies tailored to business objectives. From search engine marketing (SEM) and search engine optimisation (SEO) to social media advertising and content marketing, we utilise a number of digital platforms to maximise your online presence.

With a data-driven approach, our team can continuously monitor and optimise your digital marketing efforts to help your brokerage reach new audiences and potential prospects.

What are qualified mortgage leads

A mortgage lead can be split into two types – unqualified and qualified mortgage leads. Qualified mortgage broker leads are leads that are timely and inclusive of in-depth information. These have a greater chance of converting into a sale and should include information such as multiple contact details, the requested borrowing amount or even the level of urgency of the request.

When you are looking to generate new mortgage broker leads, you must be careful to consider the quality of the lead you are expecting to attract or receive. Our goal at MBW for example, is to ensure we always generate qualified mortgage broker leads for a broker’s business to increase the likelihood of a settlement while minimising time spent on prospects with low intent.

How to get qualified leads as a mortgage broker

Generating qualified leads as a mortgage broker is a critical aspect of growing your business, but it is important to recognise that there are no easy solutions. It is possible to purchase mortgage leads through 3rd parties between $100 – $230 per lead but often the problem with this approach is that you are paying a premium. Instead, it may be better to consider how you can create your own self-sustaining lead funnel to generate a constant pipeline at an affordable price-per-lead.

The most cost-effective methods of generating qualified mortgage leads in Australia are either through word of mouth, such as developing a referral network from accountants, financial planners or real estate agents, or by investing in a comprehensive digital marketing strategy to drive targeted traffic to your website with a high probability of conversion.

By implementing a sound digital strategy, it is possible to acquire visitors at a reasonable cost-per-click whilst providing a user experience to drive on-page conversions for lower cost-per-lead.

Uncertain if your mortgage lead marketing or website is performing well for you?

Identify areas for improvement and make informed decisions to determine how you could be generating more mortgage leads from around Australia. Our team of experts can help you gain clarity on generating mortgage broking leads and more through a free consultation. During this session we will evaluate your marketing strategies, analyse your website performance and provide you with a list of recommendations to action.

Take advantage of this free consultation to gain the confidence you need to make an investment into mortgage lead generation and drive your business forward.

A proven 17-year track record of creating mortgage leads

Our in-depth knowledge of the Australian market, coupled with our experience working with local brokerages, make us the go-to partner for mortgage brokers seeking to generate mortgage leads in Australia. We recognise the intricacies of the Australian financial landscape, ensuring that our strategies are tailored to meet the precise needs of brokers operating in the region. This localised expertise positions us as the trusted choice for brokers looking to excel in lead generation.

MBW supports mortgage brokers across all Australian states and cities and is presently collaborating with numerous brokers to enhance their mortgage broker lead generation strategies. If your website doesn’t have enough visitors, or if it’s generating thousands of visitors every month but this traffic isn’t translating into valuable leads, you’re not alone. Our team can help with a free consultation and audit to identify the precise areas that require improvement. We’ll then work closely with you to understand your unique challenges and objectives, developing a tailored strategy to transform your website into an asset that generates mortgage broker leads from Australia.