Our guide to making a mortgage broker marketing plan

QUICK LINKS

QUICK LINKS

Learn how to create a high-performing mortgage broker marketing plan using the right strategies and marketing for mortgage brokers.

20 minute read

When the average person is looking to buy a property, they are looking for support from professionals they can trust, and this includes mortgage brokers. However, there’s often a mismatch between a broker’s marketing strategies and the information clients seek for home loan decisions. Here we show you how to optimise your mortgage broker marketing plan to attract new customers, providing key insights from the hundreds of brokers we’ve worked with to demonstrate how to build an online presence that can generate returns through tested mortgage broker marketing strategies.

Getting started with your mortgage broker marketing plan

For beginners or mortgage brokers just starting out, emphasising these foundational elements can set the stage for successful customer engagement and long-term business growth.

Begin by planning your mortgage broker marketing budget

The first step to starting your mortgage broker marketing plan is to write down your budget along with any marketing costs you can think of. At this stage it’s better to over budget than under, and it’s important to consider the maximum budget you are willing to spend on your marketing because it’s easy to get carried away with features, functionality and extras.

What should your maximum budget be? Well, it depends.

When you think about mortgage broker marketing you shouldn’t be focused on costs alone. Instead you should be considering that the greater the spend, the greater the returns (more on this later). Therefore, your spend should not be based solely on budget, but rather on your growth forecasts for the business, and how aggressively you wish to expand your loan book.

Make sure you split your budget into both the initial costs of producing marketing materials and any ongoing costs associated with recurring mortgage broker marketing efforts. For example:

- Logo design: $1,000

- Business card design + print: $1,500

- Website design and build: $6,000

- Website hosting and technical support: $100/month

- Google AdWords: $2,500/month

- Search engine optimisation: $3,000/month

You don’t need to start with everything immediately but the reason we recommend budgeting in this way is to allocate resources strategically. By breaking down your budget into different categories, you can ensure that each aspect of your mortgage broker marketing receives the investment it needs to prosper. This approach will allow you to prioritise areas with the highest potential for return on investment while maintaining a balanced marketing budget. It is also important to understand that a website – just like a house – is an asset that needs maintaining and updating. If it is something you want to invest in, and if your website is well maintained, you can expect that it should produce returns in the long run.

During this period, we also recommend that you start looking for a supplier that can support your mortgage broking business with some of the broker marketing strategies and branding materials you will need, including logo design, website design, content marketing and lead generation. This way, you can begin engaging a supplier to create all your mortgage broker marketing materials while you focus on getting the other business affairs in order.

Please note that while marketing for mortgage brokers across offline channels can still be highly effective (for example, word-of-mouth), the strategies detailed in this guide focus on the use of digital marketing due to the ability to more accurately measure the results of your mortgage broker marketing efforts online.

How to select a good website name for your mortgage brokerage

When we work with brokers, we make sure to talk about website domains very early on when making a mortgage broker marketing strategy because your domain name is integral to brokerage success. Savvy mortgage brokers start exploring the availability of prospective domain names early in their business registration process, so that any mortgage broker advertising conducted later on remains relevant to the domain selected. Your website domain is also something that will grow in prominence over time when you start optimising your website for SEO so make sure you give it the extra thought it deserves.

There are many companies that allow you to register a ‘.com’ or ‘.com.au’ website domain for up to 5 years, including NetRegistry and GoDaddy to name a few. Between each of these companies, you can expect prices will be almost identical so whomever you choose to purchase your domain of is almost inconsequential. We suggest going with whichever company you are most comfortable with, or whichever one you have an existing account with – no one needs another password!

An example mortgage broker marketing plan

A good marketing plan for mortgage brokers will consider the full range of marketing channels available and how they offer value in different ways. These channels can include:

- Word-of-mouth

- Above the line advertising

- Trade marketing and events

- Social media marketing for mortgage brokers

- Digital marketing for mortgage brokers

- SEO for mortgage brokers

What works for your brokerage may not work for the next mortgage broker, and you have to consider your firm’s natural strengths, along with the total budget you are able to put aside for your mortgage broker marketing.

For experienced brokers who are comfortable with handling multiple leads at once, their marketing spend could be in excess of $100,000 per year. And, while this may seem like a lot, these brokers represent the top performing brokerages in Australia whom have optimised their marketing to generate a significant return on investment from their marketing spend.

On the other hand, if you are a mortgage broker only getting started, a sudden influx of leads could lead to wasted marketing expenses if prospects and leads cannot be serviced in time.

What to include in your mortgage broker marketing plan

A mortgage broker marketing plan can be structured as follows:

-

Market analysis: Understand your target market’s needs and preferences. Identify key demographics and customer pain points.

-

Unique selling proposition (USP): Define what sets you apart from competitors. This could be special rates, exceptional customer service, or niche expertise.

-

Online presence: Develop a professional website and maintain an active presence on relevant social media platforms. Focus on SEO to enhance visibility.

-

Content marketing: Create valuable content such as blogs, infographics, newsletters and videos that address common questions or concerns of potential clients. Then, build a subscriber list over time to share updates and personalised information.

- Client reviews and testimonials: Use positive feedback to build trust and credibility.

-

Networking: Engage in local events and join professional groups to expand your network.

-

Paid advertising: Utilise targeted online advertising to reach potential clients and generate new leads.

-

Performance tracking: Regularly analyse the effectiveness of your marketing strategies and adjust as needed.

-

Continuous Learning: Stay updated with market trends and adjust your strategies accordingly.

For a detailed guide and more specific strategies, we recommend exploring more of the resources available on our website.

Digital marketing for mortgage brokers

For most brokers, we recommend focusing on a mortgage broker marketing plan that is digitally-focused. We recommend this because digital marketing for mortgage brokers can drive leads direct to your inbox (or phone), and also because the entire digital marketing funnel can be tracked and measured so that you know where you are losing prospects, and how much your cost per lead is.

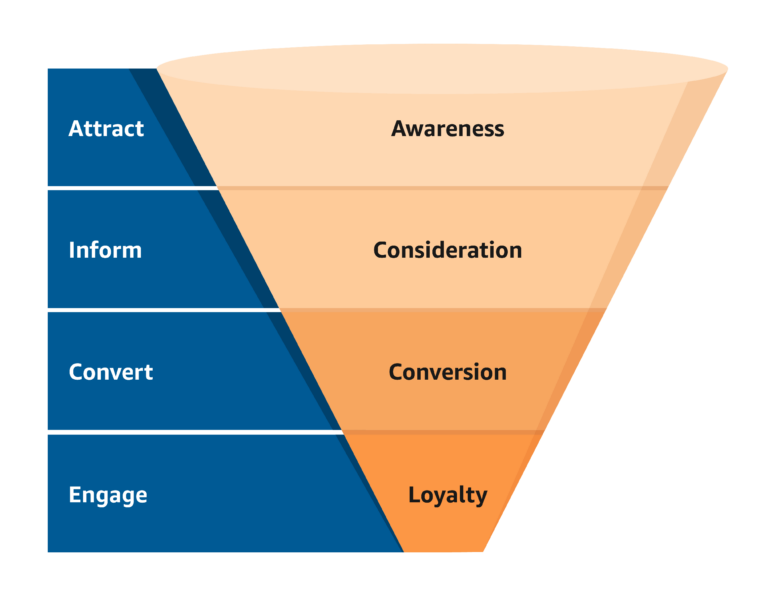

Here is an example of a marketing funnel that demonstrates how online audiences are treated. In Awareness, an online user is provided with information to make them cognisant of your service, offering or value proposition. Consideration is when the customer examines and compares your offering with other competitors to understand its benefits. And finally, Conversion is when a client takes practical steps that result in them going from a prospect to a lead – for example, submitting an enquiry with information about their home loan needs.

Each stage in the funnel can be refined in order to drive additional customers to your website before guiding them to get in touch. The more people driven to engage in this way, the greater number of leads you can expect to generate, which in turn can be converted to sales – in this case loans settled. It is for this reason that digital marketing specialists are highly sought after skill sets.

For highly-experienced brokers looking to enhance an existing marketing funnel, additional mortgage broker marketing tools such as mortgage calculators can be used to improve conversion. Interactive elements like these not only engage potential clients but also provide valuable insights into their financial situations, fostering trust and encouraging further engagement. Incorporating advanced analytics and CRM integration can also refine lead nurturing and follow-up processes, ensuring a more personalised and effective customer journey.

New mortgage broker marketing ideas

The growing number of Australians coming online for their finance and research needs has led to much more opportunities for smart brokers to utilise different kinds of mortgage broker marketing ideas. This has led to the use of things such as social media marketing to drive leads through company updates and posts, as well as marketing for mortgage brokers revolved around the purchase of online advertising across prominent websites and search engines. Today, 84% percent of shoppers begin their online product searches on digital channels that aren’t a brand’s website, so these touch points have become increasingly important when generating leads.

Consumers today also have much more choice, and it is absolutely crucial for brokers to work hard to attract new customers by helping them recognise the unique value their brokerage provides.

How much should marketing for mortgage brokers cost?

We spoke previously about using a ‘maximum budget’, but let’s some light on how you can calculate the validity of your marketing spend to determine whether it is indeed beneficial for business.

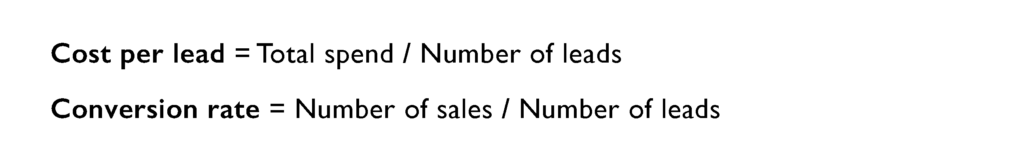

When coming up with your mortgage broker marketing plan you have to consider the total cost incurred across your marketing, including the ongoing costs. In order to know whether this total cost is worthwhile undertaking, brokers need to employ a formula to calculate their return on investment. The basis of this formula is that once you are able to determine your cost-per-lead, you can ascertain your lead-to-sale ratio in order to eventually calculate your net profit and the subsequent value you derive from your marketing.

Using this formula we can use the example of a broker who spends $2,000 per month to generate 25 leads. In this case, the broker’s cost-per-lead equals $80. Following on from this, if that same broker converts 5 out of the 25 leads into loan settlements they will have a 20% conversion rate of leads to sales and a cost-per-settlement of $400.

We can now use the same formula to forecast how many leads they would need to ramp up their business to the point they were settling 20 loans per month and the costs associated with such a growth strategy:

- A 20% conversion rate from leads to sales would require 100 leads to generate 20 loan settlements

- The cost of these 100 leads would be $80 x 100 which is $8,000 per month

If you aware of the average revenue per loan settlement, you can easily deduce that the marketing strategy was highly effective – we expand on the above equation below.

However, we also note that typically there are other costs associated with increasing the amount of loan settlements for a brokerage including an increase in administration time, staff costs, etc. Most of these expenses are fixed costs however, but brokers should still factor all of this in when determining the success of your marketing for mortgage brokers.

What is the typical cost per lead and conversion rate a mortgage broker can expect?

Most of the returns we are generating from our mortgage broker advertising and marketing ranges between $70 – 150 per lead. This disparity comes down to a few things; namely the length of time we have been able to work on a campaign, as well as how good the website is optimised for on-page conversion. Usually we are able to reduce the cost per lead over time through insights gleaned from campaign data, as well as through improving the user experience of the website. By focusing on only generating quality leads for our clients, the conversion rate of our best brokers when a lead phones through can be as high as 25% at times.

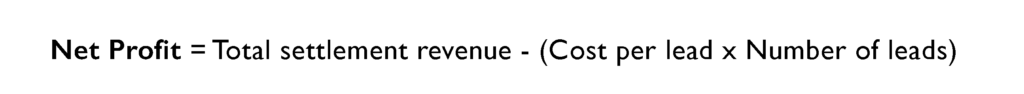

Continuing on with the example scenario, we are able to calculate the net profit this broker would have returned based on the cost of their lead generation efforts.

In order to apply this formula we need to understand how much revenue is derived from a typical loan settlement. Based on a few lenders and aggregators, upfront commission can vary from 0.5% to 1%. So for a $1,000,000 loan, a broker can receive up to $10,000 in upfront commission.

Brokers generally also receive trail commission based on the balance of the loan. In most cases, trail can range between 0.1% – 0.3% per month, but the trail typically decreases over time as clients pay down their loans. An example of this is detailed below:

- Year 1: $1,400 trail

- Year 2: $1,100 trail

- Year 3: $950 trail

- Year 4: $800 trail

- Year 5: $670 trail

Combining these numbers you can see how any additional loan settlements generated can equate to very good profit. If one such lead was closed at a $1m loan amount, this would equate to roughly $15,000 in the first five years of that lead’s book life. Returning to the example scenario, if a broker has settled 20 loans per month on an $8,000 marketing spend, the first settlement is likely to pay for the cost of their marketing with the remaining 19 loans being all profit.

Now you can see why looking at marketing expenditure without considering the associated revenue generated can be misleading. As evidenced above, marketing executed in the right way can accelerate the growth of your brokerage tremendously.

Insights from our mortgage broker marketing plan example

Whether you run your mortgage broker advertising on Facebook, Google, or any other channel, the same principles applies – calculate the cost per lead of each channel, ensure you are profiting once you deduct all expenses, and finally amplify your spend on the channels that perform best. Referencing the mortgage broker marketing plan example above, you can utilise the same formula for calculating what your return on investment is across any channel.

Speak to an expert

SEO for mortgage brokers

Now that you have the foundation for your mortgage broker marketing plan, it’s time to focus on how one specific approach – SEO for mortgage brokers – can benefit brokers looking to implement a long-term mortgage broker marketing plan in a cost-effective manner.

Generating continuous traffic and regular views to your website is a great way to sustain a constant flow of leads, yet often most brokers are unaware on how to do this effectively. While many paid mortgage broker advertising campaigns are great at generating leads rapidly, these often cost a significant amount, and once you stop the money flowing, the leads quickly follow suit.

Using search engine optimisation or SEO for mortgage brokers on the other hand, you can exponentially grow your website traffic to generate organic traffic from high-ranking content. Then once you rank well across key content pages, audiences will discover your website and brand by virtue of looking for the service they desire. Leads generated in this way can help you to subsidise the cost of paid campaigns by providing a flow of leads that are effectively free. This makes leads generated using SEO highly beneficial to a business.

At the heart of any SEO for mortgage brokers is a content management system (CMS). Without this, you will need to involve a 3rd party every time you want to update content or create new content for your website which can be costly over time.

What is a content management system

A content management system helps you to manage your content without the need for a designer or developer. It is an absolute must when creating a mortgage broker website due to the expanding importance of content in the online world, and the subsequent priority that search engines such as Google put on having quality content on your website when it comes to SEO for mortgage brokers.

If you do not have a CMS with your mortgage broker website, then we encourage you to immediately invest in creating one. There are a range of options to choose from and it will ultimately improve any of your mortgage broker marketing efforts as it allows for dynamic content creation.

Local SEO for mortgage brokers

In the highly competitive home loan industry, local SEO for mortgage brokers has emerged as a game-changer. By focusing on local SEO strategies, brokers can target specific geographical areas and connect with potential clients in their immediate vicinity. This approach has proven invaluable as it allows brokers to stand out in a sea of national and international competitors.

Through optimised local search results, Google My Business listings, and localised content, mortgage brokers can improve their visibility in local searches and establish themselves as go-to experts in their community. Emphasising local SEO not only maximises lead generation opportunities but also fosters a stronger sense of trust and credibility among potential clients, positioning brokers as reliable experts who understand the unique needs of the local market.

In the following we discuss how to choose the right CMS to compliment your local SEO strategies, and demonstrate how some of the best mortgage broker websites are using quality content to generate leads for their business on an ongoing basis.

Choosing the right CMS for your mortgage broker digital marketing

There are many well-known publicly available CMS’ used across the variety of websites in the world. Which one you choose for your mortgage broker digital marketing will ultimately depend on your unique circumstances and budget. The truth is, it is impossible to say one is better than another. Instead, it is more accurate to recognise that each CMS has its own advantages and disadvantages in digital marketing for mortgage brokers, and consider that you will need to select the one that best suits your needs.

The most popular CMS in the world is WordPress with over 50% market share (and growing). One of the main reasons WordPress has been so successful to date is its open source nature which in turn has allowed many website development companies to contribute to building new plugins and custom web features. Being open source also means that it is free – however it should be noted that an out-of-the-box WordPress implementation may require a lot of customisation to satisfy all the functional objectives of a mortgage broker website.

There are of course other CMS solutions that can be used including Wix, Squarespace, Joomla, Drupal, Kentico and Sitecore to name a few. Each has varying benefits and price ranges.

In our experience, a major reason for WordPress’ popularity is that it comes with a simple user interface. We find this of particular benefit to brokers as often they have minimal expertise in websites and are looking for an easy-to-use system for their marketing as a mortgage broker.

Disadvantages of using WordPress for your website

Being the most popular CMS in the world does come with a few disadvantages however. Mainly, a lot of WordPress sites are the focus of hackers, and because of this are prone to being attacked.

With millions of WordPress users, it is expected that some WordPress systems will be vulnerable to exploits. Yet often the misconception made is that WordPress itself is less secure or more vulnerable when compared to its peers. The reality is that because of its widespread use, WordPress websites are targeted more often as attackers can typically expect some of the WordPress websites created to be left exposed and vulnerable.

We liken this to the perception of Microsoft and Apple platforms – at one point it was held that Apple computers could not be hacked, however what was really the case was that Microsoft’s operating system was so popular it was simply the primary target for hackers around the world.

Securing your website with a custom-built mortgage broker website

In order to combat this constant targeting and make sure your website remains secure, there are a number of steps that can be taken to limit vulnerabilities, prevent downtime and optimise your marketing strategies for mortgage brokers.

The first is to make sure that your application, WordPress version and server firmware is always up-to-date and patched. Across almost all the CMS’, system updates are released on a regular basis, and often the case, administrators that are based internally do not have the time to keep up with the regularity of releases leaving websites outdated and vulnerable to exploits.

As a result, brokers should try to work with a web development company that understands server architecture and website security. This will mean you can continue to operate your business with confidence while your website is well-looked after. Our team for example, ensure that we keep abreast of OWASP Top 10 security risks and employ tools to monitor and prevent 3rd party intrusion.

Operating across the finance and mortgage broking industry also means that security is of upmost concern if you are going to create a website. If you are operating a website without proper security policies or without disaster recovery procedures in place, then you can expect that sooner or later your website will be exploited. From a business point of view, any website vulnerability can in turn have a negative impact on your credibility.

How the best mortgage brokers are using SEO to generate mortgage leads

At MBW we believe that SEO for mortgage brokers is one of the most cost-effective forms of mortgage broker marketing in the industry. SEO has been around a long time and there are plenty of resources available online that go into specific detail on search engine optimisation. For this resource we’re going to focus on what you can do yourself as part of your marketing strategy for mortgage broking.

Firstly, it’s important to understand that Google’s goal when it comes to SEO is to help the people who use their search engine find what they are looking for as quickly as possible. This is a very abstract goal, but to apply it literally means that Google will never promote a website they don’t believe to be valuable to their users – in other words if you focus on creating value for consumers then you can be assured that your intentions and Google’s align which will more likely than not improve your ranking.

Why does this matter? Well, to use an extreme case, it means that if you are wanting to rank for ‘the best mortgage broker in Australia’ and the content on your website isn’t relevant to the keywords, you should never expect to rank no matter how good your website looks or the quality of your SEO for mortgage brokers. This means any SEO marketing strategy for mortgage brokers must align content created with the keywords being targeted. Once you get your website ranking for certain keywords you can endlessly reap the benefits of that search engine ranking for as long as you can maintain your position.

While there are many variables that Google use to determine ranking, there are effectively two main guiding principles that can be used as overarching rules:

- Create quality content

- Prove your value through inbound linking

Coming up next

We show you how to start executing your mortgage broker marketing plan by explaining in detail how to create quality content. As part of this we show you how we’ve helped mortgage broker websites all around Australia increase traffic and generate new leads with the right SEO for mortgage brokers.

Need help with your mortgage broker marketing or website?

We offer a range of options from marketing to website design for mortgage brokers in Australia

Mortgage broker marketing ideas that work

Ok, so you’ve got your website up and have your mortgage broker marketing plan ready to go, now you need to figure out how to execute some of those great mortgage broker marketing ideas you have. In our final section we’re going to dive into a variety of different mortgage broker marketing ideas to demonstrate how you can turn your website into a lead generator.

How to create quality content as part of your mortgage broker marketing strategy

To recap, in the eyes of Google, quality content is the content that answers the questions of visitors. This is typically content that looks good (aesthetically pleasing to digest), covers a specific topic (of substance) and is maintained on a regular basis (timely).

You may note that the above definition doesn’t really mention word count in anyway. This is because word count by itself doesn’t matter. However with this being said, it can be noted that research has proven a correlation between the word count and the ranking of a page. We believe this is most likely occurring because in order to make in-depth quality content, it is expected you will need to write a certain amount of words.

A great tip we always ask our mortgage broker customers to consider when writing is whether or not they have anything new to add on the topic. An example of this could be if you wanted to create a page on ‘mortgage brokers’, you would need to first ask yourself what could you say that is new or different from your competitors, something that hasn’t already been said, and something that people would be searching for when they use the key phrase ‘mortgage brokers’. This line of questioning can lead you to be more specific when you create content, focusing on subject matter that can really deliver value to niche communities through your mortgage broker marketing initiatives.

An example of this could be – ‘How to know if a property in Surry Hills is overvalued?’ In this example, you would be likely to attract audiences that are interested in buying a property in the Surry Hills region, and in doing so engage them in a manner that aids them at a time when they possibly haven’t started looking for a mortgage broker – a prime time to start a conversation.

Inbound linking using the campfire analogy

When you are starting your mortgage broker business and writing website content for your mortgage broker website, you want to imagine you are creating a campfire with people gathered around the middle. Only instead of people, you will be creating new pages to gather around your main area of expertise.

Using this analogy, you want to ensure that each new page you create contributes to a larger cluster by linking direct to the main page – for example, if your campfire was for ‘website design’ you could create pages around it for each relevant industry such as ‘website design for mortgage brokers’, ‘accounting website design‘ and ‘financial advisor website design,’ and link these to your page on website design – which is exactly what we did for our own SEO strategy.

This SEO model is called a topic cluster and search engine’s such as Google depend on them to identify related information and valuable content for their users. When you are implementing your mortgage broker marketing ideas try to think of your own topic clusters around the services you provide in order to improve your SEO for mortgage brokers and broker-related search terms.

An inbound link from an external domain acts in the same way that a link from another internal page of the same domain acts. Therefore, the more links you have to your page, the more Google and other search engines are able to measure the value of your page.

From this analogy, you can see how creating specific content related to your mortgage brokerage will allow you to attract the audiences that are right for your business. In this way, writing good content serves to both attract the right kind of customer, as well as help search engines rank your website pages.

You should never be aiming to target broad words or generic descriptions, but rather focus on attracting traffic that you think is relevant to your business. If you operate your business in Surry Hills for example, then think how you can create content that is localised – ‘Mortgage Broker in Surry Hills’. Alternatively, if you specialise in a specific kind of mortgage broking such as refinancing then make sure to target those relevant keywords as part of your mortgage broker marketing plan.

Stick to Google or Facebook for mortgage broker marketing

There are many different channels that you can market your business on, and it may seem appealing to focus on all of them. However, it is always our recommendation to be targeted rather than scattered in your mortgage broker marketing approach, which is why we highly recommended sticking to only online channels and one or two platforms to begin with – particularly if you are just starting out with a limited budget.

Part of the reason behind this is because the finance and mortgage broking industries are highly competitive, and as a result, you may be pitting your marketing efforts and advertising spend against some very big players who have the means to outspend you.

Some marketing agencies may encourage you to advertise on other platforms such as Bing or Instagram but we have found that while there are wins to be had across all channels, it is a rarity, and the cost-per-lead on these other platforms are often significantly higher. Using Google’s Search Console coupled with Google Ads and Google Analytics can offer your business digital marketing precision at a cost-effective rate, while Facebook enables network-centred marketing by connecting your immediate circles. Both these platforms offer specialised tools as well as a larger audience base that you can segment and micro-target.

Both platforms will also allow you to moderate your mortgage broker marketing spend based on a variety of metrics including cost-per-acquisition, cost-per-click, cost-per-impression and more. Learn to use these metrics to adapt your campaigns on the fly, and continue to learn from the data generated from each campaign to iterate and improve.

Dive into the data of your mortgage broker digital marketing

It is imperative that throughout your website creation and marketing journey you make sure to consider the data, analytics and metrics that the digital world affords. Unlike marketing initiatives of the past, one of the key benefits of having a mortgage broker website is that all kinds of data is available. This means that your perception of whether or not your website is doing well should not be subjective, but rather based on clear identifiable goals.

Every mortgage broker marketing plan should include a series of objectives by which to measure your performance against. Some key questions for example include:

- How much traffic is coming to your website? And from what sources?

- Is that traffic converting to leads?

- Are those leads translating to sales?

- What are the value of those sales?

- What is your average cost-per-lead and cost-per-sale?

These questions will help you visualise your digital sales funnel to ultimately determine if you are profiting from your mortgage broker marketing. Each respective indicator along the way can help deduce whether or not your website is working for you and help you find ways to improve it over time. If you find that it’s not, it may be time for an upgrade.

Use these questions and the tips we’ve shared to get your website and digital channels performing for you. With careful consideration and a well planned mortgage broker marketing plan, you can be sure your business will be generating leads in no time.

For specific advice or more information on our platform, product or services, speak to a representative today.